While inflation continues to effect prices, it’s still the biggest spending season of the year. Here are some tips and tricks to help you beat inflation without losing the holiday spirit.

Book flights on Tuesdays

Booking a flight online is always a hassle, especially during the holiday season. According to the holidify blog, Tuesdays are the most affordable and cheapest day to book a flight. Because airlines post their weekly sales price on Monday evenings, this is the reason why these prices change.

Shop Small

Shopping locally is a great way to save money while supporting a small business. Purchasing your loved one hand crafted items found local not only help your community but possibly your wallet as well. Make sure to support your favorite local business.

Earn Money While You Spend

Try treating your credit card like a debit card while shopping this year. With the Credit Union ONE Rewards Mastercard, you will earn 1 point for every $1 spent. Do all your shopping while earning reward points to redeem for cash, travel, gift cards, and merchandise.

If using a credit card isn’t for you, with the Credit Union ONE Cash Back Debit Card, you will earn 1 point for every $3 you spend.

$1000 Giveaway

While using your Credit Union ONE Mastercard Credit Card to shop until December 31, 2022, you have the chance to win $1,000 with Mastercard’s Priceless Surprise Giveaway. No purchase is necessary to enter the sweepstakes. You will receive one entry with every purchase you make with an eligible Mastercard Credit Card. See official rules.

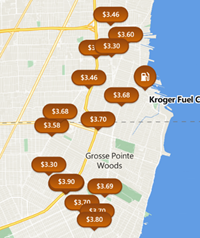

Best Gas Prices

If you are planning on doing a lot of driving this holiday season, you’ll want to save as much money as possible on gas.

Resources such as Google Maps will show you all gas prices nearby. Just search “gas prices near me” and Google shows you the latest information.

Budgeting

Keep track of all your spending this holiday season with the Credit Union ONE Budget Tool using Online Banking or our Mobile Banking App.

Personalize every budget by giving it a name, linking it to your accounts, selecting expense categories, and setting goals.