Your best weapon against fraud, scams, and identity theft is knowing what to look out for. So, let’s lay down some fraud self-defense knowledge.

NEW UPDATE, 8/20/2024:

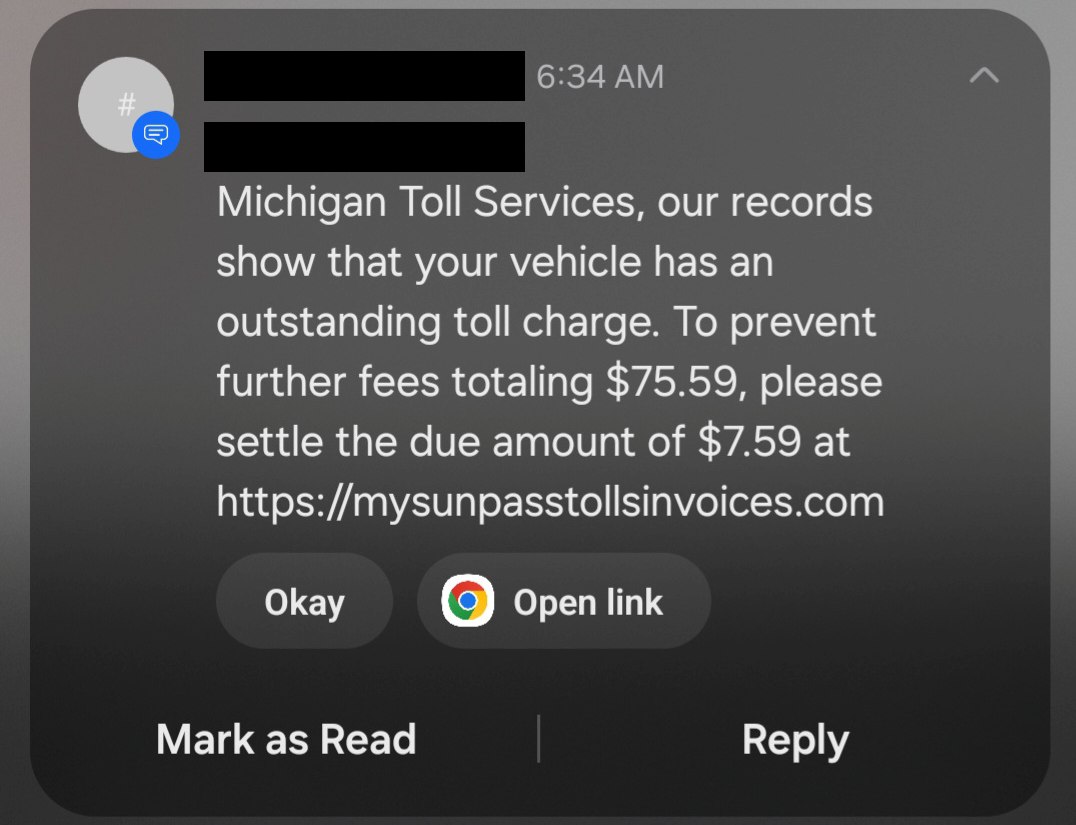

We recieved the following alert of a phishing attempt sent via text. Please consult the information below regarding text scams to learn more about how you can protect yourself.

Text Scams

Text-based scams have become popular in recent years. Since most people no longer answer their phones for unknown numbers, scammers have had to adapt. In addition, many people have their banking institutions set up to alert them when changes are being made to their accounts, hence the text appears less suspicious. In this case, you might receive a text claiming to be from "Credit Union ONE" sending verification codes or requesting immediate action. The text will also include a link to review or verify your account information. This is a malicious link that can hack into your device and steal personal information. Credit Union ONE will never ask you to confirm a code or ask that you read any codes or other sensitive information back to us.

Scammers will often send a fake verification code and instruct the recipient to visit a malicious link. In a second example, a scammer sent a text saying the account had been closed due to unusual activity, and prompted the recipient to click the link to restore access. Clicking that link would have taken the recipient to a malicious webpage where their personal informaton could be stolen.

If you receive a communication that looks suspicious and appears to be from Credit Union ONE, call our Member Contact Center at 800-451-4292 immediately and report your experience.

Learn how Credit Union ONE protects your account.

How can you protect yourself from scammers?

- Change all passwords frequently

- Set up mobile notifications so you can be alerted to suspicious activity immediately

- Do not share passwords with anyone

- If anyone calls you asking to verify your accounts, card numbers, social security, and other sensitive information, end the call immediately and call us at 800-451-4292

- Refrain from autosaving personal information on your phone or computer

- Enroll your Credit Union ONE Mastercard Credit or Debit Card in Mastercard ID Theft Protection.

- Learn more about current scam activity on the Federal Trade Commission site.

What to do if you think you’ve been scammed?

If you think you’ve been scammed with your Credit Union ONE account, call our Contact Center or Visit your nearest Branch ASAP. Depending on the circumstance, we will most likely immediately freeze the account, and review all transactions with you. We may also instruct you to visit a branch to perform a Close & Transfer of your account and create all-new online banking credentials. Even if you were not a victim of fraud, it is always in your best interest to change all online banking credentials frequently to help prevent future attempts.